Institut du Porc (IFIP), the French pork research and development institute and a key player in the French agricultural sector, has recently published its 2024 report, titled Porc par les Chiffres 2023-2024. The document provides a comprehensive overview of the global, European, and French pork industries and is a critical resource for all industry professionals.

The Global Pork Industry

The global pork industry has experienced significant changes over recent years. In 2021, global pork production reached approximately 108 million tons of carcass weight equivalent (CWE), largely driven by China’s recovery from African Swine Fever (ASF). By 2022, global production continued to rise, though at a slower pace due to the stabilization of China’s pig herd. However, the global landscape remains varied with notable regional differences.

Figure 1. Main pork exporters (in 1000 tons)*

Figure 2. Main pork importers (in 1000 tons)*

*Excluding intra-EU and intra-EUMCA-EU trade evolving: EU15 (2000-2003), EU25 (2004-2006), EU27 (2007-2013), EU28 (2014)

In Asia, China dominates pork production, contributing 47.5 million tons in 2021. Other significant producers include Vietnam, Japan, South Korea, and the Philippines. In Europe, the EU-28 collectively produced 24.6 million tons, with Germany, Spain, and France being the leading producers. In the Americas, the United States and Brazil are major contributors, with the U.S. producing 12.6 million tons and Brazil 4.4 million tons. The production in other regions like Africa and Oceania remains relatively small in comparison.

The global pork trade is equally dynamic. In 2022, the major exporters included the European Union, the United States, and Canada. Key importers were China, Japan, and Mexico. The shifting demands and production capacities have led to fluctuating trade patterns, impacting global pork prices and market stability.

Figure 3. Evolution of global pork production (GDP in 1000 tons)

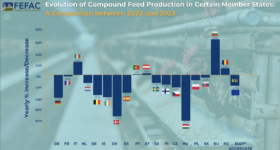

Pork Industry in the European Union

The European pork industry faced a challenging year in 2022, marked by a decline in production and various economic pressures. The EU’s pork production fell by approximately 5%, equating to a loss of over 12.6 million pigs for slaughter. Germany, historically one of the largest producers, saw a significant 10% reduction in output due to ongoing economic and sanitary crises. Spain, while typically a growing market, experienced its first production decline since 2014 due to increased piglet mortality rates from health issues.

Despite these challenges, some regions showed resilience. France managed a relatively smaller production decrease of 2%, maintaining its position as a key player in the European market. The economic environment, characterized by rising inflation and high feed costs, pushed pork prices to record levels across the continent, with French pork prices ranking high in Europe, just behind Spain.

The consumption patterns within the EU also varied significantly. Countries like Denmark and Spain exhibited high per capita pork consumption rates, while others like the United Kingdom and Italy showed more moderate consumption levels. This disparity reflects both cultural preferences and economic conditions across the region.

Figure 4. Evolution of pork production in the main EU countries (tons, from a base of 100 in 2005)

The French Pork Industry

In France, the pork industry in 2022 faced a year of significant adjustments. The country produced 2.19 million tons of carcass weight equivalent, a 3% decrease from the previous year. This decline was attributed to reduced slaughter weights and lower export volumes of live pigs. Despite these challenges, France remained the third-largest pork producer in the EU, following Spain and Germany.

Regionally, pork production is concentrated in areas like Brittany and Pays de la Loire. Brittany alone accounts for a substantial portion of the national production. The distribution of pork farms across France highlights the regional specialization, with significant variations in production volumes from one region to another.

Figure 5. Suppliers to France (percentage of total imports)

French pork exports faced hurdles due to reduced demand from China, which saw a 35% drop in imports from France in 2022. However, increased sales to other Asian markets like the Philippines and Japan partially offset this decline. In terms of value, the higher pork prices helped mitigate the impact of lower export volumes, with total export values reaching 1.76 billion euros.

Figure 6. Export targets for France (percentage of total exports)

Economic and Production Challenges

The pork industry globally and within the EU faces several ongoing challenges. Rising feed costs, largely driven by global commodity price increases, have significantly impacted production costs. In Europe, the economic downturn and ongoing health crises like ASF and PRRS (Porcine Reproductive and Respiratory Syndrome) continue to challenge producers.

In France, inflation and high production costs have led to a tightening of profit margins for pig farmers. The high costs of feed and energy, coupled with lower production volumes, have made it difficult for many producers to remain profitable. The industry has responded with efforts to improve efficiency and sustainability, though these measures take time to implement and yield results.

Future Outlook

In Asia, China’s recovery from ASF will likely stabilize, but the focus will shift towards improving biosecurity and production efficiency. In Europe, the industry will need to navigate economic challenges and health crises while adapting to changing consumer preferences towards more sustainable and ethical production practices.

For France, the key to future success will lie in balancing production efficiency with market demands. Investments in technology, biosecurity, and sustainable practices will be crucial. Additionally, expanding export markets beyond traditional partners will help mitigate the risks associated with market fluctuations.

The pork industry, both globally and within the EU, is at a pivotal point. The combination of economic pressures, health challenges, and shifting market dynamics necessitates strategic adjustments. By focusing on efficiency, sustainability, and market diversification, the industry can navigate these challenges and continue to thrive in the coming years.

The report can be read in full here.