By Technical Team, EW Nutrition

A storm has been brewing.

Even before the invasion of Ukraine in late February, global growth was expected to trend significantly downward, from 5.5-5.9% in 2021 to 4.1-4.4% in 2022 and 3.2% in 2023. The causes are similar across industries:

- rising inflation around the world

- supply chain issues stretching long into the foreseeable future, including exponentially higher freight costs

- pandemic restrictions and long-lasting effects

- rising raw material prices

In early 2022, this “perfect storm” quickly stifled the moderate optimism of Q4 2021. Of course, the worst was yet to come.

What causes sustained price increases?

With the ongoing crisis in Eastern Europe, economic perspectives are tilting down to a new level of uncertainty. The new variables now thrown into the mix are crude oil and natural gas prices, as well as added concerns over other raw materials coming out of Russia and Ukraine.

Source: tradingeconomics.com, March 2022

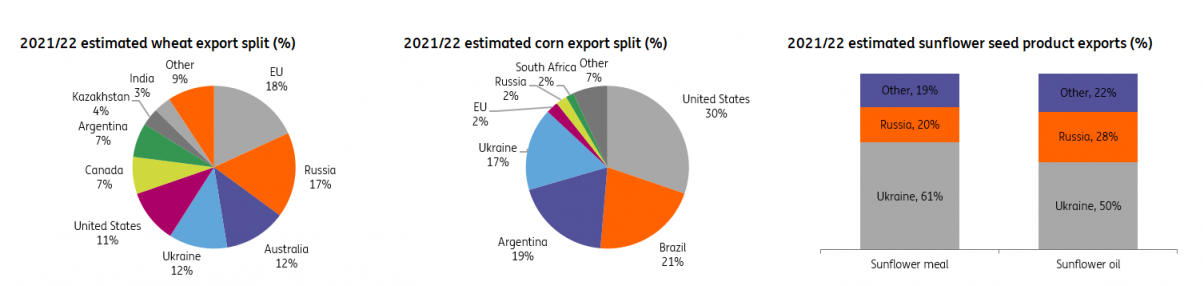

Russia accounts for 25% of the global natural gas market and 11% of the crude oil market. It is also the largest wheat exporter (China and India are still the largest producers, but Russia exports appreciably more). Together with Ukraine, also a powerhouse of agricultural exports, the two now enemies account for 29% of international annual wheat sales.

Source: ING, March 2022

Wheat prices were already nearly double the five-year average shortly before the invasion; after February 24, they rose by another 30%. Today we are at a staggering 53% increase in wheat prices in just the last few months. We are at a 14-year peak. And the countries that import the most from Russia and Ukraine (such as Egypt or Indonesia) will bear the brunt of this crisis.

Together, Russia and Ukraine’s exports account for 12% of the world’s traded calories. The two countries account for almost 30 percent of global wheat exports, almost 20 percent of corn exports, and more than 80 percent of the world supply of sunflower oil. However, the compounded effect of embargo and devastation in the two countries will surely exert tremendous influence on the global economic outlook for years to come.

What are the perspectives?

Agriculture was already hurting before February 24th. Poor harvests caused by extreme weather conditions, continued losses along the production chain, supply chain issues, and abnormal pandemic buying patterns combined to sink global wheat stocks one third lower than the five-year average. Reserves, in other words, are low – and will be significantly lower.

We need to be realistic about the coming months and years. Corn (where Ukraine accounts for 13% of global exports) and wheat will be severely hit by the war and its aftermath. This will compound all the pre-existing factors (transportation costs, supply chain slowdown, continuing weather disruptions, energy costs), none of which will trend down. Fertilizer prices have also gone up exponentially, and Russia – the largest exporter – has banned fertilizer exports at the beginning of March. The effects will be ultimately reflected in the cost of raw materials.

Ukraine and Russia have all but banned grains exports – either for security reasons or to protect internal needs. On top of this, the last harvests collected in Ukraine are now sitting in bins where ventilation and temperature controls have been affected by power cuts.

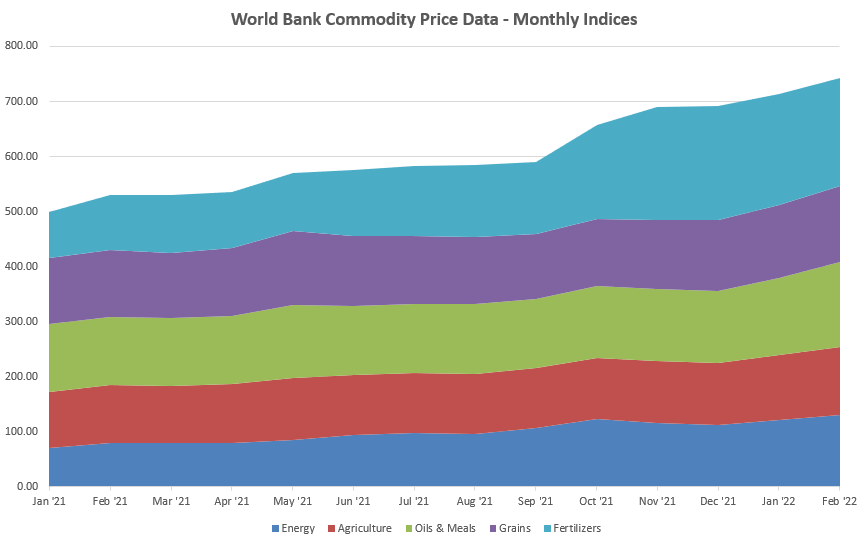

Source: World Bank, March 2022

At the end of February, World Bank data already showed upward movement for nearly all categories; whatever was not trending up at that time is catching up fast. The last time things looked like this, experts warn, was in 2008-2009 – and social unrest followed around the world, to serious global consequences.

However, the perspective is not catastrophic and there is room to conserve profitability. The essential is to intervene with fast, targeted action that favors smart optimization, localization, and long-term planning.

What can feed producers do?

Most feed producers will be caught in the middle of all rising costs, from raw materials to transport and energy. Where, then, can they look for shelter when the storm hits?

Optimize feed costs without losing performance

One of the first things feed producers will focus on will be cutting down feed costs. At this point, it is essential that this basic optimization does not impact animal health and performance. Here is what should be kept in mind.

Preserve feed material and feed quality

Whatever raw materials you choose to use, minimizing losses and maintaining quality should be the first step. Losses caused by storage are often the easiest to mitigate.

Quick intervention #1: Use mold inhibitors and mitigate the impact of mycotoxins

Compensate for lost nutrients (protein content, digestibility)

Freight costs will continue to cause pressure on transported raw materials, driving producers to local/regional options. When you replace one feed ingredient with a cheaper one, the first effects will be on the active principle and on the digestibility of the feed. Often something you are taking out of the diet cannot be replaced 1:1.

Quick intervention #2: Maximize the use of enzymes to ensure high feed digestibility; for poultry, pigments can replace corn-derived coloration (to control color variability)

Compensate for stress caused by diet changes

Adjusting the feed composition doesn’t only have effects on paper.

Even if you choose the best replacements, adjust the balance, compensate for loss of digestibility and optimize everything in every possible way, one thing remains:

The animal receives a new diet.

New diets are textbook stressors. But sometimes the nutritionist or the producer is so stressed that it is easy to overlook the stress placed inside the animal. Since animal efficiency is key for productivity, it is essential that the effects of diet stress are mitigated for the animal.

Quick intervention #3: Precautionary use of gut-health mitigating additives; also consider palatable feed materials and taste enhancers

Optimize production costs without losing quality

To optimize costs on the production floor, there are three essential areas where feed producers can act:

- Saving on energy costs and reducing the carbon footprint

- Reducing losses on the production floor

- Increasing throughput without increasing manpower

To answer these challenges, there are solutions that can operate individually. More importantly in such times, there are products that can impact all three areas without negatively influencing the quality of output. One such solution, for instance, can decrease energy costs, increase throughput and pellet quality, and reduce fines.

Quick intervention #4: Choose a solution that satisfies 3/3 of your issues

Conclusion

Climate change will continue to wreak havoc on the predictability of harvests. Freight costs are projected to keep rising. And the costs of war and (hopefully) reconstruction will take a toll on the cost of living and cost of doing business around the world, for years to come.

In the storm that has already started, it is unwise to take shelter for a while and hope for good weather soon. Cutting down on ingredients here and additives there won’t keep profitability high in the long run. Feed producers must look at all aspects – from feed storage and composition to process improvement – and consider holistic measures that protect animals and profitability at the same time.