By Inge Heinzl and Ajay Bhoyar, EW Nutrition

Genetic selection for faster growth of breast muscle in broilers may lead to increased incidences of different types of muscle degeneration. Downgrading the affected breast fillets results in high economic losses for the poultry meat industry.

The article discusses the three important myopathies impairing the breast muscles, their impact on the meat industry, influencing factors, and how to cope with these challenges.

Muscle degeneration heaps up with faster broiler growth

According to Sirri and co-workers (2016), breast fillets from broilers with 3.9 kg live weight carry a higher risk for myopathic lesions. Studies in different countries revealed that myopathies in broilers are not neglectable:

| Country |

Myopathy |

Number of breasts examined |

Conditions |

Occurrence |

Reference |

| Italy |

WS |

28,000 broilers |

commercial |

12 % |

Petracci et al., 2013 |

| Italy |

WS |

70 flocks; always 500 of 35,000 breasts randomly examined |

commercial |

43%, with 6.2% considered severe |

Lorenzi et al., 2014 |

| Italy |

WS |

57 flocks |

commercial |

70.2 % (medium)-82.5 % (heavy-weight) |

Russo et al., 2015 |

| Italy |

WS |

16,000 samples |

commercial |

9 % moderate22 % severe |

Petracci in Baldi et al., 2020 |

| Brazil |

WS |

25,520 |

commercial |

10 % |

Ferreira et al., 2014 |

| USA |

WS |

960 (week 6)+ 960 (week 9) |

experimental |

Score 1: 78.4 % (wk 6)

29.9 % (wk 9)

Score 2: 14.0 % (wk 6)

53.9 % (wk 9)

Score 3:0 % (wk 6)

15.1 % (wk 9) |

Kuttapan et al., 2017 |

| Brazil |

WB |

|

commercial |

10-20 % |

Carvalho, in Petracci et al., 2019 |

| Italy |

WB |

16,000 samples |

commercial |

42 % moderate

18 % severe |

Petracci, in Baldi et al., 2020 |

| China |

WB |

1,135 breast fillets |

commercial |

61.9% |

Xing et al., 2020 |

| USA |

WB |

960 (week 6)+ 960 (week 9) |

experimental |

Score 1: 32.5 % (wk 6)

33.2 % (wk 9)

Score 2: 7.9 % (wk 6)

36 % (wk 9)

Score 3: 1.96 % (wk 6)

15.6 % (wk 9) |

Kuttapan et al., 2017 |

| Italy |

SM |

16,000 samples |

commercial |

4 % moderate

17 % severe |

Petracci in Baldi et al., 2020 |

| Brazil |

SM |

5,580 samples |

commercial |

10 % |

Montagna et al., 2019 |

Figure 1: Different myopathies in broilers (R. Baileys)

Figure 1: Different myopathies in broilers (R. Baileys)

As the appearance of products is one of the most important arguments for the purchase decision, these myopathies are serious issues; the downgrading of the breast quality results in a lower reward for the producer. Kuttapan et al. (2016) estimated that 90 % of the broilers are affected by wooden breast and white striping (see below), causing about $200 million to $1 billion of economic losses to the U.S. poultry industry per year.

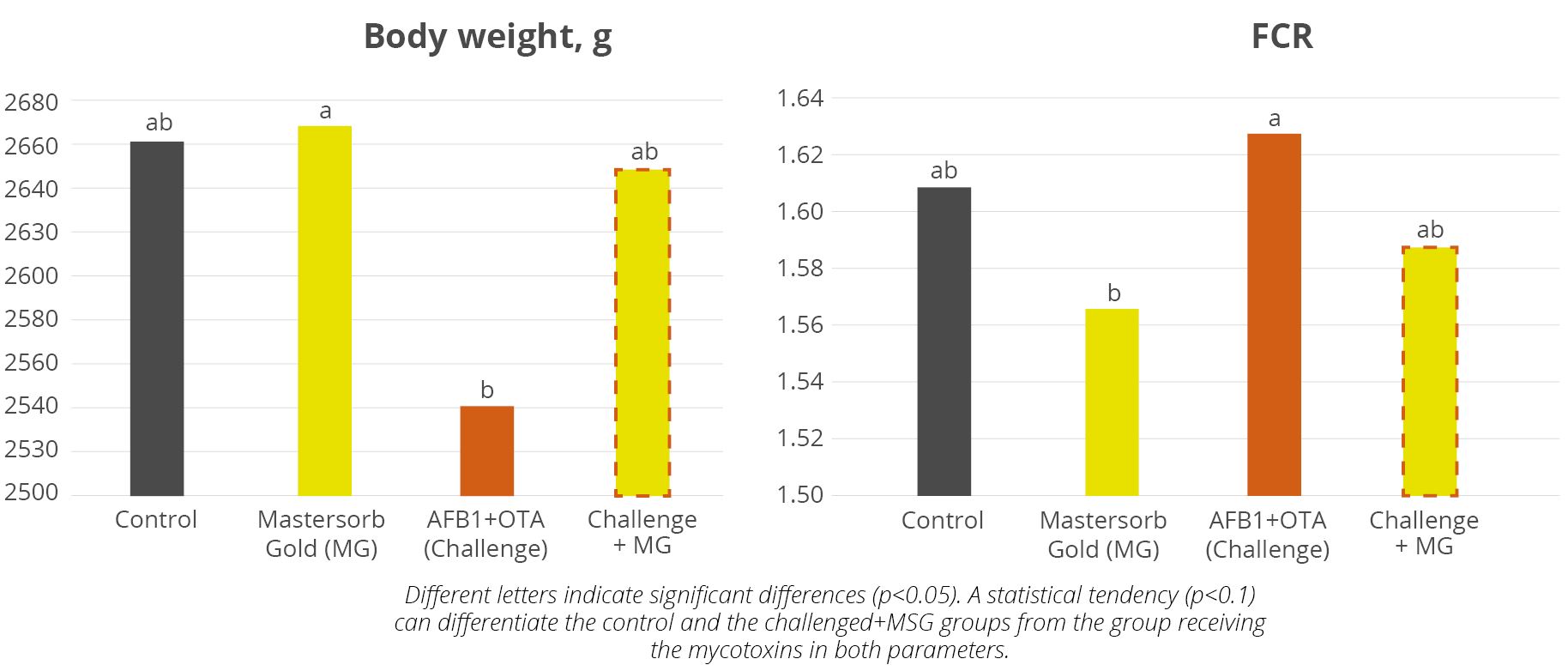

Wooden Breast (WB), a result of the proliferation of connective tissues

The muscle affected by the wooden breast is bulging and hard, is covered with clear, viscous fluid, and shows petechiae (see figure 2). The myopathy of the pectoralis major is “pale expansive areas of substantial hardness accompanied by white striation” (Kuttapan, 2016; Huang and Ahn, 2018; Sihvo et al., 2013). It is characterized by microscopically visible polyphasic myodegenerations with fibrosis in the chronic phase. At approximately two weeks of age, it appears as a focal lesion but then develops as a widespread fibrotic injury (Papah et al., 2017). WB can be detected by palpating the breast of the live bird.

Figure 2: Comparison of a severe wooden breast (on the left) and a healthy breast fillet (on the right)

Figure 2: Comparison of a severe wooden breast (on the left) and a healthy breast fillet (on the right)

Source: Kuttapan et al., 2016

According to Kuttapan et al. (2016), the anomaly is caused by circulatory insufficiency and increased oxidative stress resulting in damage and degeneration. Its occurrence rose with increasing growth and slaughter weights of the birds. Wooden breast is more common in male than female broilers as they show an increased expression of genes related to the proliferation of connective tissues (Baldi et al., 2021).

The hardness of the meat, a 1.2 – 1.3 % higher fat content (Soglia et al., 2016, Tasoniero et al., 2016), and the worse appearance lead to a degradation of the fillet quality (Kuttappan et al., 2012). The reduction in the water holding capacity of muscle results in toughness before and after cooking.

White Striping (WS), a result of fiber degeneration

The characteristics of WS are white striations parallel to the muscle fibers. A microscopic examination of these white stripes reveals an accumulation of lipids and a proliferation of connective tissue occurring in breast fillets and thighs (Kuttappan et al., 2013a; Huang and Ahn, 2018). Kuttapan et al. (2016) adapted a scoring system for the evaluation of the severity of WS, which he had established earlier (Kuttapan et al., 2012)(see picture 1). It was concluded that broilers fed a diet with high energy content led to higher and more efficient growth (improved feed conversion, higher live and fillet weights) but also to a higher percentage of fillets showing a severe degree of white striping.

Figure 3: Different degrees of white striping

- 0 = normal (no distinct white lines)

- 1 = moderate (small white lines, generally < 1 mm thick)

- 2 = severe (large white lines, 1-2 mm thick, very visible on the fillet surface)

- 3 = extreme (thick white bands, > 2 mm thickness, covering almost the entire surface of the fillet

- (scoring and image source: Kuttapan, 2016)

Moreover, the WB and WS can simultaneously occur in the same muscle (Cruz et al., 2016; Kuttappan, Hargis, & Owens, 2016; Livingston, Landon, Barnes, & Brake, 2018).

Spaghetti Meat (SM), a result of decreased collagen linking

The condition of Spaghetti Meat was first mentioned by Bilgili (2015) under “Stringy-spongy”. SM is characterized by an insufficient bonding of the muscles due to an immature intramuscular connective tissue in the pectoralis major. The fiber bundles composing the breast muscle detach, and the muscle gets soft and mushy and resembles spaghetti pasta (Baldi et al., 2021). Probably due to the reduced collagen-linking degree, the texture of SM fillets is smoother after cooking (Baldi et al., 2019). In contrast to wooden breast, SM cannot be noticed in the living animal. Meat severely impacted by SM is downgraded and can only be used in further processed products, whereas slightly affected meat can be sold in fresh retailing (Petracci et al., 2019).

Another possible explanation for this myopathy may be the enormous development of the breast muscle. The thickness of its upper section might reduce muscular oxygenation by compressing the pectoral artery (Soglia et al., 2021). The spaghetti structure generally appears mainly in the superficial layer and less in the deep ones.

Oxidative stress – one link in the chain of causes for myopathies

Oxidative stress is a result of impaired blood supply

Oxidative stress is one key factor of myopathies in breast muscle. Selection for faster growth, especially for more breast meat yield, during the last 10-20 years led to increased muscle fiber diameter. The higher pressure of the surrounding fascia on the muscle tissue compresses the blood vessels, leading to a decreased blood flow, resulting in insufficient oxygen supply (hypoxia) and limited removal of metabolic by-products (Lilburn et al., 2019) from the muscle tissue. Hypoxia as – well as hyperoxia – plus the deficient removal of metabolic waste, promote the generation of free radicals (Kähler et al., 2016; Strapazzon et al., 2016; Petrazzi et al., 2019). If the endogenous antioxidant system cannot efficiently eliminate these ROS by using endogenous and exogenous antioxidants, the ultimate effect is increased oxidative stress.

Soglia and co-workers (2016) reported higher TBARS (Thiobarbituric acid reactive substances) and protein carbonyl levels, signs of oxidative stress, in severe wooden breast muscle tissue. The oxidative stress hypothesis was also supported by gene transcription analysis conducted by Mutryn et al. (2015) and Zambonelli et al. (2017).

Oxidative stress causes damage

ROS (reactive oxygen species) or free radicals are highly reactive. They can cause damage to the DNA, RNA, proteins, and lipids in the muscle cells (Surai et al., 2015), leading to inflammation and metabolic disturbances, and, in the end, the degeneration of muscle fibers (Kuttapan et al., 2021). If the regenerative capacity of the muscle cells does not countervail against the damages caused by oxidative stress, fibrous tissue and fat accumulate and lead to myopathies such as wooden breast (Petracci et al., 2019)

Oxidative stress can be managed

To support the animals in coping with oxidative stress, combining two approaches, an external and an internal, makes sense. This entails protecting feed at the same time as protecting the animal.

Chemical antioxidants preserve feed quality and prevent oxidation

Chemical antioxidants such as ethoxyquin, BHA, and BHT efficiently prevent feed oxidation. These antioxidants prevent the oxidation of unsaturated fats/oils and maintain their energy value. They are scavengers for free radicals, protect trace minerals like Zn, Cu, Mg, Se, and Vit E from oxidation and spare them to be used in the body for different metabolic processes as well as for the endogenous antioxidant system.

Antioxidant capacity of Santoquin M 6 in feed confirmed in a trial

In a trial conducted by Kuttapan et al. (2021), Santoquin M 6, a product based on ethoxyquin, was tested concerning its ability to minimize the oxidative damage caused due to the feeding of oxidized fat. A control group receiving oxidized fat in feed was compared to a group receiving oxidized fat plus 188 ppm Santoquin M6 (≙125 ppm ethoxyquin). The main parameters for this study were TBARS in the breast muscle, the incidence of wooden breast, and the live weight on day 48.

Results indicated that the inclusion of Santoquin M 6 reduced the level of TBARS in the breast muscles, demonstrating a lower level of oxidative stress in the breast muscles. Additionally, it improved the 48-day live weight by 131 g.

The results also indicated that the inclusion of Santoquin M 6 reduced the incidence of severe woody breasts (Score 3) by almost half. It can be concluded that the inclusion of Santoquin in the broiler feed not only improves the production performance but also help mitigate the impact of breast muscle degradation due to increased oxidative stress.

Phytomolecules act as natural antioxidants and reduce lipid oxidation in breast muscles

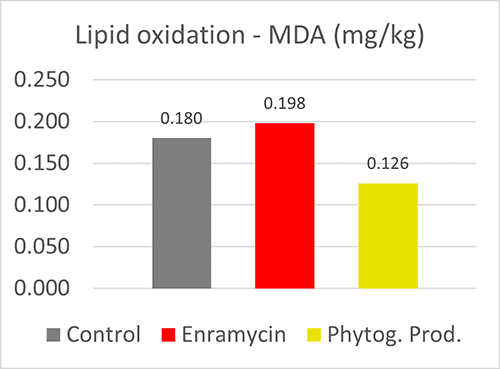

Inside the body, phytomolecules help to mitigate oxidative stress by the direct scavenging of ROS and the activation of antioxidant enzymes. Phytogenic compounds like Carvacrol and thymol possess phenolic OH-groups that act as hydrogen donors (Yanishlieva et al., 1999). These hydrogens can “neutralize” the peroxy radicals produced during the first step of lipid oxidation and, therefore, retard the hydroxyl peroxide formation. The increase in serum antioxidant enzyme activities and a resulting lower level of malondialdehyde (MDA) can be caused by cinnamaldehyde (Lin et al., 2003). MDA is a highly reactive dialdehyde generated as a metabolite in the degradation process of polyunsaturated fatty acids.

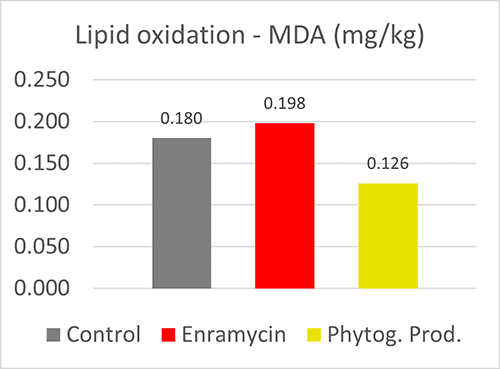

Antioxidant capacity of phytomolecules demonstrated in broilers

A trial with 480 Cobb male chicks (3 treatments, 8 replicates) was conducted at the University of Viçosa (Brazil). The breast muscles of the birds fed a blend of phytomolecules showed lower MDA levels and thus reduced lipid oxidation compared to the negative control, but also to the birds fed an antibiotic.

The impact of breast muscle degradation in broilers can be mitigated

The downgrading of broiler meat due to increased incidence of breast muscle myopathies is a common issue, resulting in the significant economic losses to the broiler meat producers. Oxidative stress caused due to due faster growth rate and various other stressors, including the oxidation of feed and feed ingredients, can contribute to increased incidence of woody breast and white striping. Different nutritional and management strategies are employed to reduce WB and WS in broiler production. The inclusion of synthetic antioxidants to control the oxidation in feed as well as phytomolecules to support the endogenous antioxidant system can be a part of promising tools to mitigate the impact of breast myopathies and reduce economic losses in broiler production.

References:

Alnahhas, Nabeel, Cécile Berri, Marie Chabault, Pascal Chartrin, Maryse Boulay, Marie Christine Bourin, and Elisabeth Le Bihan-Duval. “Genetic Parameters of White Striping in Relation to Body Weight, Carcass Composition, and Meat Quality Traits in Two BROILER Lines Divergently Selected for the Ultimate PH of the Pectoralis Major Muscle.” BMC Genetics 17, no. 1 (2016). https://doi.org/10.1186/s12863-016-0369-2.

Baldi, Giulia, Francesca Soglia, and Massimiliano Petracci. “Current Status of Poultry Meat Abnormalities.” Meat and Muscle Biology 4, no. 2 (2020). https://doi.org/10.22175/mmb.9503.

Baldi, Giulia, Francesca Soglia, and Massimiliano Petracci. “Spaghetti Meat Abnormality in Broilers: Current Understanding and Future Research Directions.” Frontiers in Physiology 12 (2021). https://doi.org/10.3389/fphys.2021.684497.

Baldi, Giulia, Francesca Soglia, Luca Laghi, Silvia Tappi, Pietro Rocculi, Siria Tavaniello, Daniela Prioriello, Rossella Mucci, Giuseppe Maiorano, and Massimiliano Petracci. “Comparison of Quality Traits among Breast Meat Affected by Current Muscle Abnormalities.” Food Research International 115 (2019): 369–76. https://doi.org/10.1016/j.foodres.2018.11.020.

Boerboom, Gavin, Theo van Kempen, Alberto Navarro-Villa, and Adriano Pérez-Bonilla. “Unraveling the Cause of White Striping in Broilers Using Metabolomics.” Poultry Science 97, no. 11 (May 28, 2018): 3977–86. https://doi.org/10.3382/ps/pey266.

Carvalho, Leila M, Josué Delgado, Marta S Madruga, and Mario Estévez. “Pinpointing Oxidative Stress behind the White Striping Myopathy: Depletion of Antioxidant Defenses, Accretion of Oxidized Proteins and Impaired Proteostasis.” Journal of the Science of Food and Agriculture 101, no. 4 (2020): 1364–71. https://doi.org/10.1002/jsfa.10747.

Editors, AccessScience. “U.S. Bans Antibiotics Use for Enhancing Growth in Livestock.” Access Science. McGraw-Hill Education, January 1, 1970. https://www.accessscience.com/content/u-s-bans-antibiotics-use-for-enhancing-growth-in-livestock/BR0125171.

Ferreira, T.Z., R.A. Casagrande, S.L. Vieira, D. Driemeier, and L. Kindlein. “An Investigation of a Reported Case of White Striping in Broilers.” Journal of Applied Poultry Research 23, no. 4 (2014): 748–53. https://doi.org/10.3382/japr.2013-00847.

Hashemipour, H., H. Kermanshahi, A. Golian, and T. Veldkamp. “Effect of Thymol and Carvacrol Feed Supplementation on Performance, Antioxidant Enzyme Activities, Fatty Acid Composition, Digestive Enzyme Activities, and Immune Response in Broiler Chickens.” Poultry Science 92, no. 8 (2013): 2059–69. https://doi.org/10.3382/ps.2012-02685.

Huang, Xi, and Dong Uk Ahn. “The Incidence of Muscle Abnormalities in Broiler Breast Meat – a Review.” Korean journal for food science of animal resources 38, no. 5 (October 2018): 835–50. https://doi.org/10.5851/kosfa.2018.e2.

Kolakshyapati, Manisha. “Proteoglycan and Its Possible Role in ” Wooden Breast ” Condition in Broilers.” Nepalese Journal of Agricultural Sciences 13 (September 1, 2015): 253–60.

Kuttappan, V.A., B.M. Hargis, and C.M. Owens. “White Striping and Woody Breast Myopathies in the Modern Poultry Industry: A Review.” Poultry Science 95, no. 11 (2016): 2724–33. https://doi.org/10.3382/ps/pew216.

Kuttappan, V.A., C.M. Owens, C. Coon, B.M. Hargis, and M. Vazquez-Añon. “Incidence of Broiler Breast Myopathies at 2 Different Ages and Its Impact on Selected Raw Meat Quality Parameters.” Poultry Science 96, no. 8 (2017): 3005–9. https://doi.org/10.3382/ps/pex072.

Kuttappan, V.A., H.L. Shivaprasad, D.P. Shaw, B.A. Valentine, B.M. Hargis, F.D. Clark, S.R. McKee, and C.M. Owens. “Pathological Changes Associated with White Striping in Broiler Breast Muscles.” Poultry Science 92, no. 2 (2013): 331–38. https://doi.org/10.3382/ps.2012-02646.

Kuttappan, V.A., Y.S. Lee, G.F. Erf, J.-F.C. Meullenet, S.R. McKee, and C.M. Owens. “Consumer Acceptance of Visual Appearance of Broiler Breast Meat with Varying Degrees of White Striping.” Poultry Science 91, no. 5 (2012): 1240–47. https://doi.org/10.3382/ps.2011-01947.

Kuttappan, Vivek A., Megharaja Manangi, Matthew Bekker, Juxing Chen, and Mercedes Vazquez-Anon. “Nutritional Intervention Strategies Using Dietary Antioxidants and Organic Trace Minerals to Reduce the Incidence of Wooden Breast and Other Carcass Quality Defects in Broiler Birds.” Frontiers in Physiology 12 (2021). https://doi.org/10.3389/fphys.2021.663409.

Kuttappan, Vivek A., Megharaja Manangi, Matthew Bekker, Juxing Chen, and Mercedes Vazquez-Anon. “Nutritional Intervention Strategies Using Dietary Antioxidants and Organic Trace Minerals to Reduce the Incidence of Wooden Breast and Other Carcass Quality Defects in Broiler Birds.” Frontiers in Physiology 12 (2021). https://doi.org/10.3389/fphys.2021.663409.

Kähler, Wataru, Frauke Tillmans, Sebastian Klapa, Inga Koch, Julia Last, and Andreas Koch. “Oxidativer Stress Durch Hyperbare Hyperoxie Und Dessen Wirkung Auf Periphere Mononukleäre Zellen (PBMC) – Eine Übersicht Über Den Aktuellen Forschungsstand Am Schifffahrtmedizinischen Institut Der Marine.” Wehrmedizinische Monatsschrift 60, no. 2 (2016): 50–55.

Lake, Juniper A., and Behnam Abasht. “Glucolipotoxicity: A Proposed Etiology for Wooden Breast and Related Myopathies in Commercial Broiler Chickens.” Frontiers in Physiology 11 (2020). https://doi.org/10.3389/fphys.2020.00169.

Lilburn, M.S., J.R. Griffin, and M Wick. “From Muscle to Food: Oxidative Challenges and Developmental Anomalies in Poultry Breast Muscle.” Poultry Science 98, no. 10 (2019): 4255–60. https://doi.org/10.3382/ps/pey409.

Lin, Chun-Ching, Sue-Jing Wu, Cheng-Hsiung Chang, and Lean-Teik Ng. “Antioxidant Activity of Cinnamomum Cassia.” Phytother. Res. 17 (August 7, 2003): 726–30. https://doi.org/ https://doi.org/10.1002/ptr.1190.

Linden, Jackie. “Deep Pectoral Myopathy (Green MUSCLE Disease) in Broilers.” The Poultry Site, August 9, 2021. https://www.thepoultrysite.com/articles/deep-pectoral-myopathy-green-muscle-disease-in-broilers.

Lorenzi, M., S. Mudalal, C. Cavani, and M. Petracci. “Incidence of White Striping under Commercial Conditions in Medium and Heavy Broiler Chickens in Italy.” Journal of Applied Poultry Research 23, no. 4 (2014): 754–58. https://doi.org/10.3382/japr.2014-00968.

Martindale, L., W.G. Siller, and P.A.L. Wight. “Effects of Subfascial Pressure in Experimental Deep Pectoral Myopathy of the Fowl: An Angiographic Study.” Avian Pathology 8, no. 4 (1979): 425–36. https://doi.org/10.1080/03079457908418369.

Montagna, FS, G Garcia, IA Nääs, NDS Lima, and FR Caldara. “Practical Assessment of Spaghetti Breast in Diverse Genetic Strain Broilers Reared under Different Environments.” Brazilian Journal of Poultry Science 21, no. 2 (2019). https://doi.org/10.1590/1806-9061-2018-0759.

Mutryn, Marie F, Erin M Brannick, Weixuan Fu, William R Lee, and Behnam Abasht. “Characterization of a Novel Chicken Muscle Disorder through DIFFERENTIAL Gene Expression and Pathway Analysis Using Rna-Sequencing.” BMC Genomics 16, no. 1 (2015). https://doi.org/10.1186/s12864-015-1623-0.

National Chicken Council. “Per Capita Consumption of Poultry and LIVESTOCK, 1965 to Forecast 2022, in Pounds.” National Chicken Council, June 28, 2021. https://www.nationalchickencouncil.org/about-the-industry/statistics/per-capita-consumption-of-poultry-and-livestock-1965-to-estimated-2012-in-pounds/.

Papah, Michael B., Erin M. Brannick, Carl J. Schmidt, and Behnam Abasht. “Evidence and Role Of Phlebitis and LIPID Infiltration in the Onset and Pathogenesis of Wooden Breast Disease in MODERN Broiler Chickens.” Avian Pathology 46, no. 6 (2017): 623–43. https://doi.org/10.1080/03079457.2017.1339346.

Petracci, M., F. Soglia, M. Madruga, L. Carvalho, Elza Ida, and M. Estévez. “Wooden-Breast, White Striping, and Spaghetti MEAT: Causes, Consequences and Consumer Perception of Emerging Broiler MEAT ABNORMALITIES.” Comprehensive Reviews in Food Science and Food Safety 18, no. 2 (2019): 565–83. https://doi.org/10.1111/1541-4337.12431.

Petracci, M., S. Mudalal, A. Bonfiglio, and C. Cavani. “Occurrence of White Striping under Commercial Conditions and Its Impact on Breast Meat Quality in Broiler Chickens.” Poultry Science 92, no. 6 (2013): 1670–75. https://doi.org/10.3382/ps.2012-03001.

Ruberto, Giuseppe, and Maria T Baratta. “Antioxidant Activity of SELECTED Essential Oil Components in Two Lipid Model Systems.” Food Chemistry 69, no. 2 (2000): 167–74. https://doi.org/10.1016/s0308-8146(99)00247-2.

Russo, Elisa, Michele Drigo, Corrado Longoni, Raffaele Pezzotti, Paolo Fasoli, and Camilla Recordati. “Evaluation of White Striping Prevalence and Predisposing Factors in Broilers at Slaughter.” Poultry Science 94, no. 8 (2015): 1843–48. https://doi.org/10.3382/ps/pev172.

Schulze, Dieter. “Aktuelles Aus Der Broilermast .” Presentation – 7. Tagung des VET Arbeitskreises Geflügelforschung Tiergesundheit beim Nutzgeflügel, Rust, 2018.

Sihvo, H.-K., K. Immonen, and E. Puolanne. “Myodegeneration with Fibrosis and Regeneration in the Pectoralis Major Muscle of Broilers.” Veterinary Pathology 51, no. 3 (May 26, 2014): 619–23. https://doi.org/10.1177/0300985813497488.

Sirri, F., G. Maiorano, S. Tavaniello, J. Chen, M. Petracci, and A. Meluzzi. “Effect of Different Levels of Dietary Zinc, Manganese, and Copper from Organic or Inorganic Sources on Performance, Bacterial Chondronecrosis, Intramuscular Collagen Characteristics, and Occurrence of Meat Quality Defects of Broiler Chickens.” Poultry Science 95, no. 8 (2016): 1813–24. https://doi.org/10.3382/ps/pew064.

Soglia, Francesca, Luca Laghi, Luca Canonico, Claudio Cavani, and Massimiliano Petracci. “Functional Property Issues in Broiler Breast Meat Related to Emerging Muscle Abnormalities.” Food Research International 89 (2016): 1071–76. https://doi.org/10.1016/j.foodres.2016.04.042.

Strapazzon, Giacomo, Sandro Malacrida, Alessandra Vezzoli, Tomas Dal Cappello, Marika Falla, Piergiorgio Lochner, Sarah Moretti, Emily Procter, Hermann Brugger, and Simona Mrakic-Sposta. “Oxidative Stress Response to Acute Hypobaric Hypoxia and Its Association with Indirect Measurement of Increased Intracranial Pressure: A Field Study.” Scientific Reports 6, no. 1 (2016). https://doi.org/10.1038/srep32426.

Surai F, Peter. “Antioxidant Systems in Poultry Biology: Superoxide Dismutase.” Journal of Animal Research and Nutrition 01, no. 01 (2016). https://doi.org/10.21767/2572-5459.100008.

Tasoniero, G., M. Cullere, M. Cecchinato, E. Puolanne, and A. Dalle Zotte. “Technological Quality, Mineral Profile, and Sensory Attributes of Broiler Chicken Breasts Affected by White Striping and Wooden Breast Myopathies.” Poultry Science 95, no. 11 (2016): 2707–14. https://doi.org/10.3382/ps/pew215.

United Nations. “How Your Company Can Advance Each of THE SDGS: UN Global Compact.” How Your Company Can Advance Each of the SDGs | UN Global Compact. Accessed August 31, 2021. https://www.unglobalcompact.org/sdgs/17-global-goals.

Xing, T., X. Zhao, L. Zhang, J.L. Li, G.H. Zhou, X.L. Xu, and F. Gao. “Characteristics and Incidence of Broiler Chicken Wooden Breast Meat under Commercial Conditions in China.” Poultry Science 99, no. 1 (2020): 620–28. https://doi.org/10.3382/ps/pez560.

Zambonelli, Paolo, Martina Zappaterra, Francesca Soglia, Massimiliano Petracci, Federico Sirri, Claudio Cavani, and Roberta Davoli. “Detection of Differentially Expressed Genes in Broiler Pectoralis Major Muscle Affected by White Striping – Wooden Breast Myopathies.” Poultry Science 95, no. 12 (2016): 2771–85. https://doi.org/10.3382/ps/pew268.

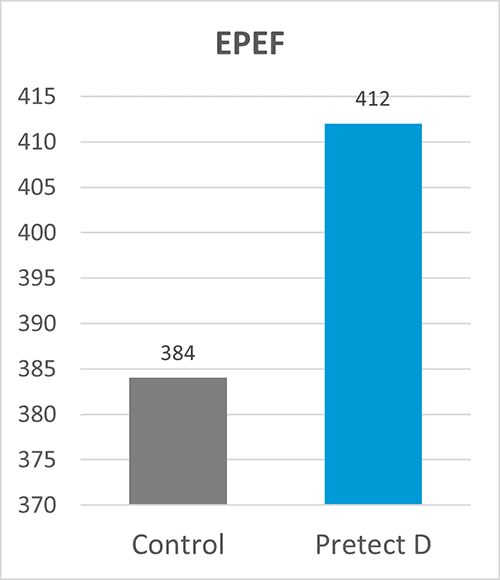

Table 1: Exemple of including Pretect D into coccidiosis control programs

Table 1: Exemple of including Pretect D into coccidiosis control programs