Biosecurity is the foundation for all disease prevention programs (Dewulf, et al., 2018), and one of the most important points in antibiotic reduction scenarios. It includes the combination of all measures taken to reduce the risk of introduction and spread of diseases. It is based on the prevention of and protection against infectious agents by understating the disease transmission processes.

The application of consistently high standards of biosecurity can substantially contribute to the reduction of antimicrobial resistance, not only by preventing the introduction of resistance genes into the farm but also by lowering the need to use antimicrobials (Davies & Wales, 2019).

Lower use of antimicrobials with higher biosecurity

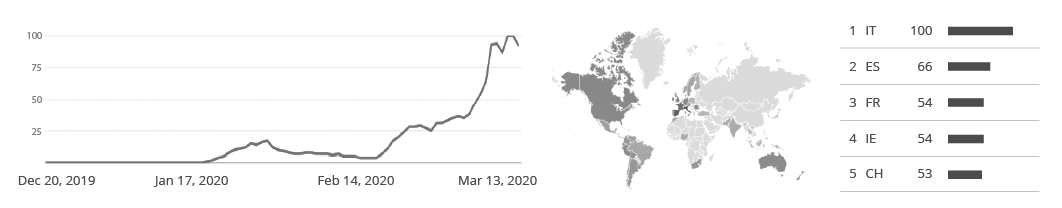

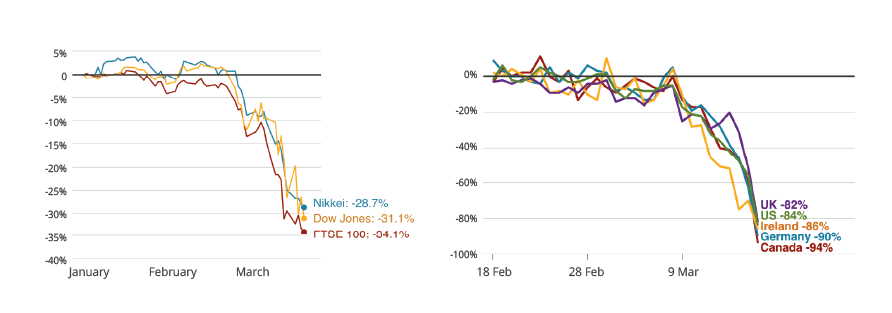

Several studies and assessments relate that high farm biosecurity status and/or improvements in biosecurity lead to reduced antimicrobial use (Laanen, et al., 2013, Gelaude, et al., 2014, Postma, et al., 2016, Collineau, et al., 2017 and Collineau, et al., 2017a). Laanen, Postma, and Collineau studied the profile of swine farmers in different European countries, finding a relation between the high level of internal biosecurity, efficient control of infectious diseases, and reduced need for antimicrobials.

Reports on reduction on antibiotic use due to farm interventions are also available. Gelaude, et al. (2014), evaluated data from several Belgian broiler farms, finding a reduction of antimicrobial use by almost 30% within a year when biosecurity and other farm issues were improved. Collineau et al. (2017) studied pig farms in Belgium, France, Germany, and Sweden, in which the use of antibiotics was reduced on average by 47% across all farms. The researches observed that farms with the most strict biosecurity protocols, higher compliance, and who also took a multidisciplinary approach (making other changes, e.g. in management and nutrition), achieved a greater reduction of antibiotic use.

Biosecurity interventions pay off

Of course, the interventions necessary to achieve an increased level of biosecurity carry some costs. However, the interventions have proven to also improve productivity. Especially if taken with other measures such as improved management of newborn animals and nutritional improvements. The same studies which report that biosecurity improvements decrease antibiotics use also report an improvement in animal performance. In the case of broilers, Laanen (2013) found a reduction of 0.5 percentual points in mortality and one point in FCR; and Collineau (2017) reported a reduction in mortality in pigs during both the pre-weaning and fattening period of 0.7 and 0.9 percentual points, respectively.

Execution

Although biosecurity improvements and other interventions necessary for antibiotic reduction programs are well known, continuous compliance of these interventions is often low and difficult. The implementation, application, and execution of any biosecurity program involve adopting a set of attitudes and behaviors to reduce the risk of entrance and spread of disease in all activities involving animal production or animal care. Measures should not be constraints but part of a process aimed to improve health of animals and people, and a piece of the multidisciplinary approach to reduce antibiotics and improve performance.

Designing effective biosecurity programs: consider five principles

When designing or evaluating biosecurity programs, we can identify five principles that need to be applied (Dewulf, et al., 2018). These principles set the ground for considering and evaluating biosecurity interventions:

1. Separation: Know your enemy, but don’t keep it close

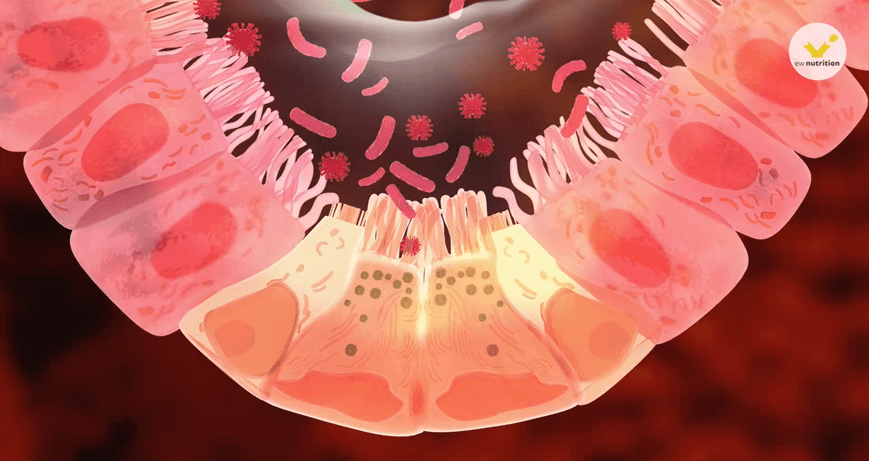

It is vital to have a good definition of the perimeter of the farm, a separation between high and low-risk animals, and dirty and clean internal areas on the farm. This avoids not only the entrance but the spread of disease, as possible sources of infection (e.g. animals being introduced in the herd and wild birds) cannot reach the sensitive population.

2. Reduction: Weaken your enemy, so it doesn’t spread

The goal of the biosecurity measures is to keep infection pressure beneath the level which allows the natural immunity of the animals to cope with the infections (Dewulf, et al., 2018). Lowering the pressure of infection e.g. by an effective cleaning and disinfection program, by the reduction of the stocking density, and by changing footwear when entering a production house.

3. Focus: Hunt the elephant in the room, shoo the butterflies

In each production unit, some pathogens can be identified as of high economic importance due to their harm and frequency. For each of these, it is even more important, to understand the likely routes of introduction into a farm and how it can spread within it. Taking into consideration that not all disease transmission routes are equally significant, the design of the biosecurity program should focus first on high-risk pathogens and transmission routes, and only subsequently on the ones lower-risk (Dewulf, et al., 2018).

4. Repetition: When the danger is frequent, the probability of injury is increased

In addition to the probability of pathogen transmission via the different transmission routes, the frequency of occurrence of the transmission route is also highly significant when evaluating a risk (Alarcon, et al., 2013). When designing biosecurity programs, risky actions such as veterinary visits, if repeated regularly must be considered with a higher risk.

5. Scaling: In the multitude, it is easy to disguise

The risks related to disease introduction and spread are much more important in big farms (Dorea, et al., 2010); more animals may be infected and maintain the infection cycle, also large flocks/herds increase the infection pressure and increase the risk by contact with external elements such as feed, visitors, etc.

Can we still improve our biosecurity?

Almost 100% of poultry and swine operations already have a nominal biosecurity program, but not in all cases is it fully effective. BioCheck UGent, a standardized biosecurity questionnaire applied in swine and broiler farms worldwide, shows an average of 65% and 68% in conformity, respectively, from more than 3000 farms between both species (UGent, 2020). Therefore, opportunities to improve can be found in farms globally, and they pay off.

To find these opportunities, consider three situations you need to know:

- Know your menace: Identify and prioritize the disease agents of greatest concern for your production system by applying the principles of focus and repetition. Consider the size of the facility when evaluating risks applying the scaling

- Know your place: Conduct an assessment of the facility. A starting point is to define the status quo. For that, operation-existing questionnaires or audits can be used. However, the “new eyes principle” should be applied and an external questionnaire such as BioCheck UGent (biocheck.ugent.be) is recommended. The questionnaire will help you identify gaps in your biosecurity plan as well as processes that may be allowing pathogens to enter or move from one location to another, and measures that can be implemented applying the principles of separation and reduction.

- Know your processes: Implement processes and procedures that apply the biosecurity principles and help to eliminate, prevent, or minimize the potential of disease. A deep evaluation of the daily farm processes will aid in risk mitigation, considering, among others, movement of personnel, equipment, and visitors, the entrance of pets, pests and vermin, dealing with deliveries and handling of mortality and used litter.

Compliance – The weak link in biosecurity programs

Achieving systematic compliance of biosecurity protocols on a farm is a complex, interactive, and continuous process influenced by several factors (Delabbio, 2006) and an ongoing challenge for animal production facilities (Dewulf, et al., 2018). Thus, it is clear that the biosecurity plan can only be effective if everyone on the operation follows it constantly, i.e. if everyone performs in compliance.

Compliance can be defined as the extent to which a person’s behavior coincides with the established rules. Thus, compliance with biosecurity practices should become part of the culture of the facility. Poor compliance in relation with biosecurity can be connected to:

- Lack of knowledge or understanding of the biosecurity protocols (Alarcon, et al., 2013; Cui & Liu, 2016; Delpont, et al., 2020)

- Lack of consequences for non-compliance (Racicot, et al., 2012a)

- A company culture of inconsistent or low application of biosecurity protocols (Dorea, et al., 2010)

In general terms, compliance with biosecurity procedures has been found to be incomplete in different studies (Delpont, et al., 2020; Dorea, et al., 2010; Gelaude, et al., 2014; Limbergen, et al., 2017). In one study (Racicot, et al., 2011) used hidden cameras, to asses biosecurity compliance in Quebec, Canada and found 44 different biosecurity fails made by 114 individuals (farm workers and visitors) in the participating poultry farms, over the course of 4 weeks; in average four mistakes were made per visit. The most frequent mistakes were ignoring the delimitation between dirty and clean areas, not changing boots, and not washing hands at the entrance of the barns; these three mistakes were committed in more than 60% of the occasions, regardless of being farm employees or visitors. These are frequent breaches not only of those farms in Quebec but found frequently in many animal production units around the world and have a high probability of causing the entrance and spread of pathogens.

How to create a high biosecurity culture: start now!

Creating, applying, and maintaining a biosecurity culture is the most effective way to make sure that compliance of the biosecurity program and procedures is high on the farm. Decreasing, therefore, the probability of entrance and spread of pathogens, reducing the use of antimicrobials, and maintaining animal health. Some actions are recommended in order to achieve a high biosecurity culture:

1. Name an accountable person

Every operation should have a biosecurity coordinator who is accountable for developing, implementing, and maintaining the biosecurity program.

This important position should be appointed having in mind that certain personality traits may facilitate performance and execution of the labor (Delabbio, 2006; Racicot, et al., 2012; Laanen, et al., 2014; Delpont, et al., 2020) such as responsibility, orientation to action, and being able to handle complexity. Additionally, expertise – years working in the industry y- and orientation to learn are strategic (Racicot, et al., 2012).

2. Set the environment

When the farm layout is not facilitating biosecurity, compliance is low (Delabbio, 2006), thus the workspace should facilitate biosecurity workflows and at the same time make them hard to ignore (Racicot, et al., 2011).

3. Allow participation

It is important to mention that not only the management and the biosecurity coordinator are responsible for designing and improving biosecurity procedures. Biosecurity practices must be owned by all the farm workers and should be the social norm.

The annual or biannual revision of biosecurity measures should be done together with the farm staff. This not only serves the purpose of assessing compliance but also allows the personnel to suggest measures addressing existing -often overlooked– gaps, and to be frank about procedures that are not followed and the reasons for it. At the same time, participation increases accountability and responsibility for the biosecurity program.

4. Train for learning

Don’t take knowledge for granted. Even when a person has experience in farm work and has been working in the industry for several years, their understanding and comprehension around biosecurity may have gaps.

People are more likely to do something when they see evidence of the activity’s benefit. Therefore, if workers are told about the effectiveness of the practices, showing the benefits of biosecurity and analyzing the consequences of non-compliance, they are most likely to follow the procedures (Dewulf, et al., 2018). Knowledge of disease threats and symptoms also improves on-farm biosecurity (Dorea, et al., 2010), thus workers should recognize the first symptoms of disease in animals and act upon them.

Discussion of ‘What if…?’ scenarios to gain an understanding of the key aspects of farm biosecurity should be held on a regular basis. Workers should see examples of the benefits of compliance – and risks of noncompliance – as part of their training.

5. Lead by example

A high biosecurity culture requires everyone to comply regardless of status.

Personnel practice of biosecurity procedures is not only affected by the availability of resources and training, but also by the position that management takes on biosecurity and the feedback provided. The management and owners must transmit a message of commitment to the farm personnel, owning and following biosecurity practices, procedures and protocols, giving positive and negative feedback on the personnel’s compliance, supplying information on farm performance and relating it with biosecurity compliance and ensuring adequate resources for the practice of biosecurity (Delabbio, 2006).

When necessary, management also should enforce personnel compliance by disciplinary measures, firings, and creating awareness about the consequences of disease incidence. Nevertheless, the recognition of workers’ contribution to animal health performance also has a positive impact on biosecurity compliance (Dorea, et al., 2010).

The bottom line

Biosecurity is necessary for disease prevention in any animal production system. Actions and interventions that prevent the entrance and spread of disease in a production unit have a pay-off as they often lead to performance improvements and lower antimicrobial use. Maintaining a successful production unit requires a multidisciplinary approach in which biosecurity compliance needs to be taken seriously and also actions to improve in other areas such as management, health, and nutrition.

Authors: Marisabel Caballero, Global Technical Manager Poultry, and Fellipe Freitas Barbosa, Global Technical Manager Swine, EW Nutrition.

References

Alarcon, P., Wieland, B., Pereira, A. L. & Dewberry , C., 2013. Pig Farmer’s perceptions, attitudes, influences, and management of information in the decision-making process for disease control. Preventive Veterinary Medicine, 116(3).

Collineau, L. et al., 2017. Profile of pig farms combining high performance and low antimicrobial usage within four European countries. Veterinary Record, Volume 181.

Collineau, L. et al., 2017a. Herd-specific interventions to reduce antimicrobial usage in pig production without jeopardizing technical and economic performance. Preventive Veterinary Medicine.

Cui, B. & Liu, Z. P., 2016. Determinants of Knowledge and Biosecurity Preventive Behaviors for Highly Pathogenic Avian Influenza Risk Among Chinese Poultry Farmers. Avian Diseases, 60(2).

Davies , R. & Wales, A., 2019. Antimicrobial Resistance on Farms: A Review Including Biosecurity and the Potential Role of Disinfectants in Resistance Selection. Comprehensive Reviews in Food Science and Food Safety.

de Gussem, M. et al., 2016. Broiler Signals. First ed. Zutphen: Roodbont Publishers.

Delabbio, J., 2006. How farmworkers learn to use and practice biosecurity. Journal of Extension, 44(6).

Delpont, M. et al., 2020. Determinants of biosecurity practices in French duck farms after an H5N8 Pathogenic Avian Influenza epidemic: The effect of farmer knowledge, attitudes and personality traits. Transboundary and Emerging Diseases.

Dewulf, J. et al., 2018. Biosecurity in animal production and veterinary medicine. First ed. Den Haag: Acco Nederland.

Dorea, F., Berghaus, R., Hofacre, C. & Cole, D., 2010. Biosecurity protocols and practices adopted by growers on commercial poultry farms in Georgia USA. Avian Diseases, 54(3).

Gelaude, P. et al., 2014. Biocheck.UGent: A quantitative tool to measure biosecurity at broiler farms and the relationship with technical performances and antimicrobial use. Poultry Science.

Laanen, M. et al., 2014. Pig, cattle, and poultry farmers with a known interest in research have comparable perspectives on disease prevention and on-farm biosecurity. Preventive Veterinary Medicine.

Laanen, M. et al., 2013. Relationship between biosecurity and production/antimicrobial treatment characteristics in pig herds. The Veterinary Journal, 198(2).

Limbergen, T. et al., 2017. Scoring biosecurity in European conventional broiler production. Poultry Science.

Postma, M. et al., 2016. Evaluation of the relationship between the biosecurity status, production parameters, herd characteristics, and antimicrobial usage in farrow-to-finish pig production in four EU countries. Porcine Health Management.

Racicot, M., Venne, D., Durivage, A. & Vaillancourt, J.-P., 2011. Description of 44 biosecurity errors while entering and exiting poultry barns based on video surveillance in Quebec, Canada. Preventive veterinary medicine, Volume 100.

Racicot, M., Venne, D., Durivage, A. & Vaillancourt, J.-P., 2012a. Evaluation of strategies to enhance biosecurity compliance on poultry farms in Quebec: Effects of audits and cameras. Preventive veterinary medicine, Volume 103.

Racicot, M., Venne, D., Durivage, A. & Vaillancourt, J.-P., 2012. Evaluation of the relationship between personality traits, experience, education, and biosecurity compliance on poultry farms in Quebec, Canada. Preventive veterinary medicine, Volume 103.

UGent, b., 2020. biocheck UGent. [Online]

Available at: www.biocheck.ugent.be

Moscow – September 18, 2019 – VITOMEK and EW Nutrition are pleased to announce that they have signed a distribution partnership agreement, combining the accumulated knowledge, experience, and effective solutions in the field of animal nutrition at VitOmek with a portfolio of comprehensive programs, innovative products, and services from EW Nutrition.

Moscow – September 18, 2019 – VITOMEK and EW Nutrition are pleased to announce that they have signed a distribution partnership agreement, combining the accumulated knowledge, experience, and effective solutions in the field of animal nutrition at VitOmek with a portfolio of comprehensive programs, innovative products, and services from EW Nutrition.