The lessons of 2025 for poultry and feed producers

by Ilinca Anghelescu, Global Director Marketing & Communications, EW Nutrition

2025 was a year defined by four converging forces for the global feed and animal production industry: an unprecedented HPAI crisis that cost American consumers alone $14.5 billion extra in egg expenditures; historic record corn production driving feed ingredient prices lower; a highly disruptive US tariff regime that reshuffled global trade flows for soybeans, corn, chicken, and pork; and accelerating regulatory pressure on antimicrobial use across Europe and globally.

The strategic imperatives from 2025 are clear: biosecurity investment is no longer optional, ingredient price volatility demands agile procurement strategies, trade compliance is a weekly operational concern, and antibiotic-free production transitions require credible, phased plans now.

KEY METRIC: Global chicken meat production reached approximately 105 million MT in 2025 (+2%), even as egg production suffered severely. The global feed market is valued at $542 billion in 2025, growing at 3.3% CAGR. Corn hit record production of 17 billion bushels in the US alone – the highest since 1936 in terms of harvested area.

DOWNLOAD THE REPORT HERE.

CHAPTER 1: HPAI & DISEASE LANDSCAPE

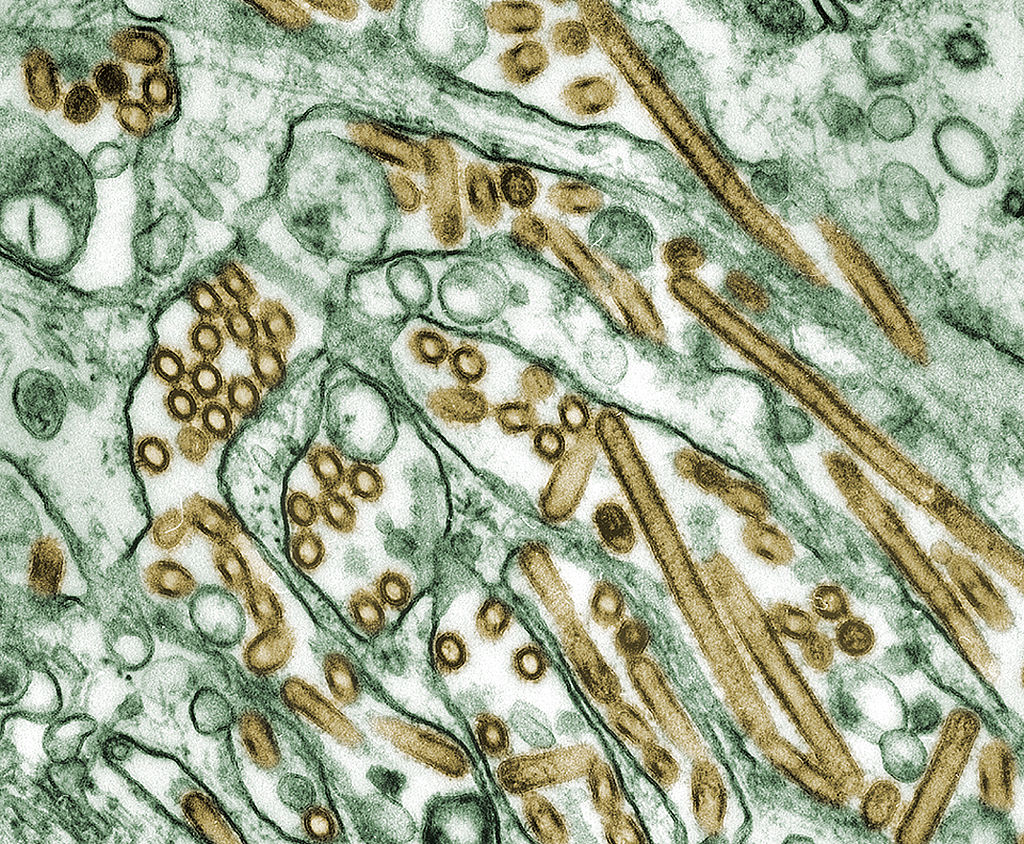

1.1 The Ongoing H5N1 Crisis – Scale & Impact

The H5N1 clade 2.3.4.4b strain of Highly Pathogenic Avian Influenza (HPAI) continued to dominate animal health headlines in 2025. Since its reemergence in February 2022, the US outbreak alone has resulted in the confirmed loss of over 175 million birds across 1,700+ flocks – the costliest poultry disease event in recorded history.

| Metric | Data Point | Source |

| Total US birds affected (2022–2025) | 175+ million | USDA APHIS, May 2025 |

| US flocks confirmed positive | 1,704+ | USDA APHIS, May 2025 |

| Proportion of affected birds: layers | 75% | USDA / Congressional Research Service |

| US egg layer flock deficit vs. 2022 | –8% fewer birds | CoBank / USDA |

| Consumer egg overspend (May 2024–Apr 2025) | $14.5 billion extra | Innovate Animal Ag analysis |

| Peak US retail egg price | $6.23/dozen (March 2025) | BLS / USDA |

| HPAI-related US taxpayer response costs | $1.8 billion+ | Innovate Animal Ag |

| Global HPAI mammal outbreaks (2024) | 1,022 (vs. 459 in 2023) | WOAH 2025 |

| Countries self-declaring HPAI freedom (May 2025) | 25 | WOAH |

1.2 2025-Specific Developments

United States: Early-Year Severity, Policy Response

The first six weeks of 2025 saw 28 million layers depopulated – the worst start to any calendar year on record. Ohio, Indiana, and Missouri bore the brunt. The USDA launched a five-pronged approach in February 2025 including:

- Gold-standard biosecurity assessments (948 completed Jan 20–June 26)

- Indemnity increase from $7 to $17 per lost layer hen

- Importation of 26+ million dozen shell eggs from Brazil, Honduras, Mexico, Turkey, and South Korea

- Removal of select regulatory burdens to accelerate flock repopulation

- $793 million in HPAI research proposals received in response to USDA Innovation Grand Challenge

⚠ Price Manipulation Investigation: In April 2025, the DOJ Antitrust Division launched an investigation into the largest US egg producer after it reported a 247% increase in quarterly net income. Egg producers and retailers face ongoing scrutiny over whether crisis pricing exceeded what supply constraints warranted.

Brazil: First Commercial HPAI Outbreak – May 2025

On May 15, 2025, Brazil – the world’s largest poultry exporter, responsible for nearly 30% of global exports – confirmed its first-ever commercial HPAI case at a breeder facility in Montenegro, Rio Grande do Sul (17,000 birds). This was a watershed event for global poultry trade.

| Consequence | Detail |

| China (#1 buyer of Brazilian chicken) suspended imports | Trade suspended as of May 2025; Chinese delegation visited RS in Sept 2025 to assess resumption |

| Brazil’s monthly poultry exports declined | Exports fell 12.9% to $655 million; volume down 14.4% to 363,100 MT (May) |

| UAE replaced China as Brazil’s top buyer | First time China dropped from #1 buyer since 2019 |

| WOAH new 10-year global HPAI strategy launched | Prevention and Control of HPAI (2024–2033), February 2025 |

| Regionalized trade bans helped contain damage | Bans limited to affected regions, not all of Brazil |

Europe: Persistent Pressure

HPAI continued to circulate widely in European poultry and wild bird populations. Key 2025 events include recurrence in Australia (February), ongoing outbreaks in Germany, Hungary, Netherlands, UK, and France, and the first confirmed domestic cat HPAI death in the Netherlands (H5N1, November 2025).

CRITICAL RISK: HPAI is now classified as enzootic (endemic) in wild birds across North America by the CDC. The virus circulates year-round in wildlife reservoirs, making seasonal recurrence in commercial flocks a structural, not episodic, risk. US egg producers are 8% below their 2022 flock baseline.

1.3 Other Priority Diseases in 2025

| Disease | Region/Status | Operational Impact |

| Avian Metapneumovirus (AMPV) | USA – significant in turkey sector | Reduced breeder egg production; compounded HPAI losses; estimated 18.7M turkeys affected alongside HPAI in 2025 |

| Salmonella (all serovars) | EU-wide – statistically significant increase trend 2020–2024 per EFSA/ECDC joint report, March 2025 | AMR pressure in broilers and layers; genomic surveillance being mandated by EU |

| Newcastle Disease (NCD) | Brazil – outbreak July 2024, RS state | First commercial NCD in Brazil since 2006; adds biosecurity burden on top of HPAI protocols |

| H5N1 in Dairy Cattle (USA) | Ongoing – cross-species spread to 50+ US states | Cattle-to-poultry transmission confirmed; biosecurity interfaces between dairy and poultry operations must be reviewed |

| HPAI – Antarctica | First confirmed case March 2024 (South Polar Skua) | Indicates virus reached every continent; unprecedented in poultry disease history |

CHAPTER 2: GLOBAL POULTRY PRODUCTION

2.1 Global Output – 2025 Performance

Despite HPAI disruptions, global chicken meat production grew approximately 2% in 2025 to around 105 million MT (ready-to-cook), driven by demand resilience and lower feed costs for broiler production. Total global poultry meat (including turkey, duck, and others) is forecast to exceed 152 million MT for 2025, per FAO Food Outlook June 2025.

| Country / Region | 2025 Production Forecast (MT) | Year-on-Year Change | Key Driver |

| USA – Broilers | 21.7 million MT | +1.4% vs. 2024 | Strong hatchery data; lower feed costs; HPAI minimal in broilers |

| China | 15.3 million MT | Positive growth | Rising domestic demand; pork sector recovery stabilizing |

| Brazil | 15.1 million MT | Positive growth (despite HPAI) | Export demand; improved margins; population-driven domestic growth |

| European Union | Slight increase | Modest growth | Domestic demand; reduced Ukrainian imports |

| USA – Turkey | Decline –2.5% | vs. –6.35% prior year | HPAI + AMPV pressure; wholesale prices +40% YoY |

| Global Total (chicken) | ~105 million MT | +2% | Affordability vs. beef; consumer demand in developing markets |

OECD-FAO 10-Year Outlook (2025–2034)

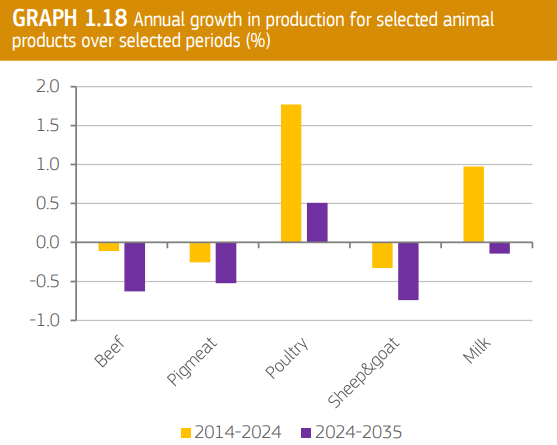

The OECD-FAO Agricultural Outlook 2025–2034, released in July 2025, projects global poultry meat production will grow by over 19% to 173.4 million MT by 2034 compared to the 2022–24 average. Poultry will account for the majority of additional meat consumption globally, driven by:

- Affordability relative to beef and pork, especially in price-sensitive emerging markets

- Population and income growth in Southeast Asia, South Asia, and Sub-Saharan Africa

- Rapid urbanization and expansion of Quick Service Restaurant (QSR) chains

- Superior feed conversion ratio (FCR) and lower greenhouse gas emissions per kg of protein

STRATEGIC NOTE: In high-income countries, per capita poultry consumption growth is flattening as consumers focus increasingly on welfare, environment, and health attributes. Growth opportunity is almost entirely in middle-income markets. Product premiumization (antibiotic-free, cage-free, organic) is the North American and European story.

2.2 Egg Production – Crisis Sector

Egg production was the sector hardest hit by HPAI globally. In the US, 75% of all HPAI-affected birds were table-egg layers, despite layers comprising less than 4% of the total poultry population. This structural vulnerability reflects longer flock lifespans and, increasingly, cage-free housing adoption.

| Indicator | 2025 Data |

| US retail egg price peak | $6.23/dozen (March 2025) |

| US retail egg price decline from peak | –27% by June 2025 (wholesale –64%) |

| US retail egg price (January 2025) | $4.95/dozen – 96% higher than January 2024 |

| USDA full-year 2025 egg price forecast | +41.1% vs. 2024 average |

| % of US laying flock in cage-free systems | ~40% (120+ million birds) |

| Global hen egg production (2023 baseline) | 91 million tonnes (~1.7 trillion eggs) |

| Global egg trade volume (2024) | Nearly doubled from prior years |

⚠ Cage-Free Transition & Disease Vulnerability: Some analysts link cage-free housing to higher HPAI susceptibility. Regardless of epidemiological debate, the US cage-free market is now structurally undersupplied relative to corporate commitments made in 2014–2017. Producers face a squeeze: comply with welfare commitments while managing disease risk.

CHAPTER 3: FEED INGREDIENT MARKETS

3.1 Grain & Oilseed Prices – 2025 Summary

From a feed cost perspective, 2025 was broadly favorable for livestock and poultry producers. Record US corn production and generally adequate global grain and oilseed supplies put downward pressure on the major feed commodities, offering partial relief from the margin pressure of recent years.

| Commodity | 2025 Price Direction | Key 2025 Data | Implication for Feed |

| Corn (US) | DOWN –3.9% (3rd consecutive annual decline) | Record US crop: 17.0 billion bu; yield 186.5 bu/acre – record; harvested area highest since 1936 | Favorable for poultry/swine FCR cost; season avg ~$4.15/bu projected |

| Soybean Meal | DOWN –4.3% (3rd consecutive decline) | Prices at lowest since early 2016 at one point; large South American supply weighing on markets | Significant reduction in diet protein cost; amino acid supplementation cost-competitive |

| Soybeans | UP slightly +3.3% | After 22.9% collapse in 2024; still well below historical peaks; US acreage declining | Bean oil +20.8% (energy diet component); meal-to-bean ratio remains attractive for crushers |

| Wheat (Chicago) | DOWN –4.3% (4th consecutive year) | Abundant global supply; Russia/Argentina record crops; increased feed use | Wheat competing with corn in feed formulations globally – inclusion rising in EU/Asia diets |

| Soybean Oil | UP +20.8% | Driven by biofuel demand (US 45Z renewable fuel credits) | Energy ingredient cost pressure; may affect fat inclusion rates in formulations |

PROCUREMENT SIGNAL: The US/China trade tensions created windows of soybean buying opportunity as prices swung on trade deal news. China agreed to purchase US soybeans in late 2025 as part of a limited trade deal, causing a price uptick. Procurement teams should monitor US-China negotiations as a lead indicator for soybean pricing in 2026.

3.2 Global Feed Market Overview

| Metric | 2025 Data |

| Global animal feed market value | $542.36 billion |

| CAGR (2026–2034) | 3.3% |

| Largest feed segment by additive type | Amino acids (33.6% share) |

| Largest feed segment by species | Poultry (dominant share) |

| Asia Pacific regional status | Dominant region (largest market) |

| Top feed ingredient challenge | Fluctuating prices for corn, SBM – still key risk for margin management |

3.3 Key Ingredient Trends to Watch

Fertilizer Cost Relief

Fertilizer prices have declined significantly from their 2022 peak. A basket of N, P, and K fertilizers averaged $437/tonne in May 2025, down from the $815/tonne peak in April 2022, per FAO Food Outlook. This benefits grain production economics and should support adequate grain supplies into 2026.

Soybean Oil Competition: Biodiesel vs. Feed

US soybean oil demand from renewable fuel programs (the 45Z credit) competed directly with feed-grade fat supplies, pushing soy oil prices up 20.8% in 2025. Feed mills formulating with added fats should evaluate alternative lipid sources. Poultry fat and palm olein remain cost-competitive in some markets.

Alternative Proteins: Insect Meal, DDGS, Algae

While adoption remains limited in volume, regulatory acceptance of insect meal in EU poultry diets continues to expand. Dried Distillers Grains with Solubles (DDGS) remain a strategically important co-product, particularly in the US and EU. Feed formulators should have up-to-date matrix values and be prepared to use them when corn prices favor inclusions.

⚠ Tariff Risk for Feed Inputs: US feed manufacturers faced effective tariff rates averaging 12%+ on key agricultural inputs from China and other countries in 2025, including herbicides, pesticides, and some micro-ingredient precursors. Amino acid supplies (predominantly Chinese-origin lysine, methionine, threonine) faced added cost and supply uncertainty.

CHAPTER 4: TRADE POLICY DISRUPTIONS

4.1 The 2025 US Tariff Regime – Agricultural Impact

The Trump administration’s tariff policies beginning January 20, 2025, represented the most significant disruption to global agricultural trade in decades. The three largest US agricultural export markets – Mexico ($30.3B in 2024), Canada ($28.3B), and China ($24.7B) – were all targeted, triggering retaliatory measures that hit feed, grain, poultry, and pork exports.

| Country | US Tariff (2025) | Retaliation on US Agriculture | Key Products Impacted for Feed/Poultry Industry |

| China | Reached 145% (paused to 30% via May 2025 truce) | 15% on chicken, corn, wheat; 10% on soybeans, sorghum, pork – applied from March 2025 | Chinese poultry buyers shifted away from US; US corn/soy export disruption; amino acid supply chain uncertainty |

| Canada | 25–35% (escalated to 35% in Aug) | 25% on US dairy, poultry, meat products ($21B) | Canada imports ~45% of US poultry exports; feed grain flows affected |

| Mexico | 25–30% (USMCA-compliant goods largely exempted) | Retaliatory tariffs threatened on agricultural goods | Mexico is #1 market for US turkey exports; ongoing uncertainty |

| EU | 14% (paused under negotiations) | Planned retaliation announced April 2025 | Potential impact on US soy meal exports; EU feed ingredient costs |

CHINA TRADE DEAL (MAY 2025): A 90-day tariff truce agreed May 12, 2025 reduced US tariffs on Chinese goods from 145% to 30%, and China’s tariffs on US products from 125% to 10%. China agreed to purchase US soybeans. No permanent deal was signed. The limited agreement provided short-term stability but medium-term uncertainty remains.

4.2 Impact on US Agricultural Trade Flows

| Product | Trade Flow Change (2025) | Implication |

| Corn exports | UP >20% YoY | Record US production driving export competitiveness despite tariff uncertainty |

| Soybean exports | DOWN – China shifted to South America | Brazil and Argentina taking larger share of Chinese soy imports |

| US chicken exports | Maintained overall (6.8B USD) | Despite China restrictions, other markets (Middle East, Mexico) absorbed volume |

| US turkey exports | At risk – 10% of production exported; Mexico = 65% of turkey exports | HPAI + AMPV supply squeeze threatened export volumes at peak holiday season |

| Brazil chicken exports | Down 12.9% month of May impact; year-end positive | HPAI disruption in May/June; recovery in H2 2025 after regionalization |

| US egg imports (temporary) | 26M dozen shell eggs imported | Emergency imports from Brazil, Honduras, Turkey, South Korea, Mexico to fill supply gap |

4.3 Strategic Trade Lessons

- Supply chain diversification is no longer a luxury: concentration of US soy exports to China created a single-point-of-failure vulnerability that became fully exposed in 2025.

- Regionalized disease zoning is a trade-preserving tool: Brazil’s rapid implementation of regionalized HPAI bans (rather than country-wide) preserved most of its export access; this is the model the industry should support with regulators globally.

- USMCA dependency is real: 70% of US corn, 60% of soybeans, 45% of poultry exports go to Mexico, Canada, China – the same three countries targeted by 2025 tariffs.

- US government announced $12B in emergency farm compensation in 2025, repeating the pattern from Trump’s first term – indicating persistent trade disruption risk.

CHAPTER 5: REGULATORY CHANGES

5.1 EU: Feed & Food Safety Legislation Simplification

In 2025, the European Commission proposed a package to streamline EU food and feed safety legislation while maintaining high health standards. The initiative, announced mid-2025, is intended to boost competitiveness of EU producers by reducing regulatory complexity – a direct response to competitive concerns vs. non-EU producers.

5.2 EFSA 2025 Guidance on Microorganisms

On September 24, 2025, EFSA’s Scientific Committee adopted new harmonized guidance on the characterization of microorganisms in the food chain. This is a landmark shift with major implications for feed additive manufacturers, probiotics suppliers, and novel food applicants.

| Key Element | Operational Implication |

| Whole Genome Sequencing (WGS) now mandatory for strain-level ID of all bacteria, yeasts, fungi, viruses in applications | All existing microbial feed additive dossiers must be reviewed; WGS data cannot be more than 2 years old at time of submission |

| Genomics-first approach to AMR assessment | Any AMR gene hit in curated databases triggers mandatory case-by-case assessment; significantly raises the regulatory bar for probiotics and fermentation products |

| Replaces multiple previous guidance documents | Companies must align R&D, QC, and regulatory documentation to new unified standard immediately |

| GM microorganisms: clearer differentiation | Products ‘produced by GMO’ now distinguished from ‘GMO active agents’ – critical for enzyme and probiotic positioning |

| Non-compliance = application rejection risk | Early non-alignment causes ‘clock-stops’ or formal rejection at EFSA suitability check stage |

5.3 Antimicrobial Resistance (AMR) – Regulatory Pressure

AMR remains the defining long-term regulatory risk for the animal feed and production industry. Key 2025 actions:

- EFSA/ECDC Joint Report (March 2025): Highlighted persistently high resistance to critical antimicrobials in poultry, especially Campylobacter and Salmonella, with ‘statistically significant increasing trend 2020–2024.’ This directly fuels EU legislative pressure.

- EU Regulation 2019/6 (Veterinary Medicines) – Article 118: Banning import of animal products containing antimicrobials used for growth promotion. Application delayed to 2026, raising questions about enforcement timelines – and competitive fairness regarding imports from countries still allowing AGPs.

- EU AMR Implementation Decision 2023: New harmonized monitoring requirements for AMR in zoonotic and indicator bacteria from food-producing animals – effective January 1, 2025. All EU Member States now required to collect and report standardized AMR surveillance data.

- WOAH 10-Year HPAI Strategy (2024–2033): Promotes surveillance, vaccination programs, and timely reporting as cornerstones of international HPAI management.

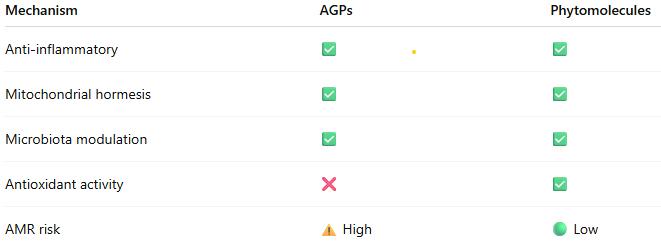

BOTTOM LINE ON AMR: The regulatory trajectory is clear and irreversible – sub-therapeutic antibiotic use for growth promotion is being eliminated globally. The timeline varies by region (already banned in EU since 2006; US voluntary approach from 2017; global WHO action plan). Companies that have already invested in transition are ahead; those that have not face increasing compliance risk and market access restrictions.

5.4 US Regulatory Developments

| Action | Status / Detail |

| USDA Five-Pronged HPAI Response Plan (Feb 2025) | Biosecurity assessments, indemnity increases, import flexibility, vaccine research funding, regulatory burden removal |

| HPAI Innovation Grand Challenge | $793M in proposals received (417 submissions); awards expected by fall 2025; covers prevention, vaccines, therapeutics |

| DOJ Antitrust Investigation – Egg Producers | Launched April 2025; examining price-fixing allegations amid 247% profit increase by largest producer |

| Meat & Poultry Special Investigator Act (S.1312) | Proposed creation of Office of Special Investigator for Competition Matters within USDA – pending |

| Food Security & Farm Protection Act (S.1326) | Would prohibit states from imposing certain standards on preharvest agricultural production sold in interstate commerce – relevant to cage-free mandates |

CHAPTER 6: FEED ADDITIVE & NUTRITION STRATEGIES

PRECISION NUTRITION SIGNAL: The industry’s shift to reduced crude protein (CP) diets, precisely supplemented with industrial amino acids (L-Lys, DL-Met, L-Thr, L-Trp, L-Val) remained the dominant reformulation strategy in 2025. Lower CP diets reduce feed cost, lower N excretion (environmental benefit), and reduce substrate for pathogenic bacteria. With amino acid prices remaining favorable, there are few economic arguments for maintaining high CP diets.

6.1 The Post-AGP Transition: Where the Industry Stands

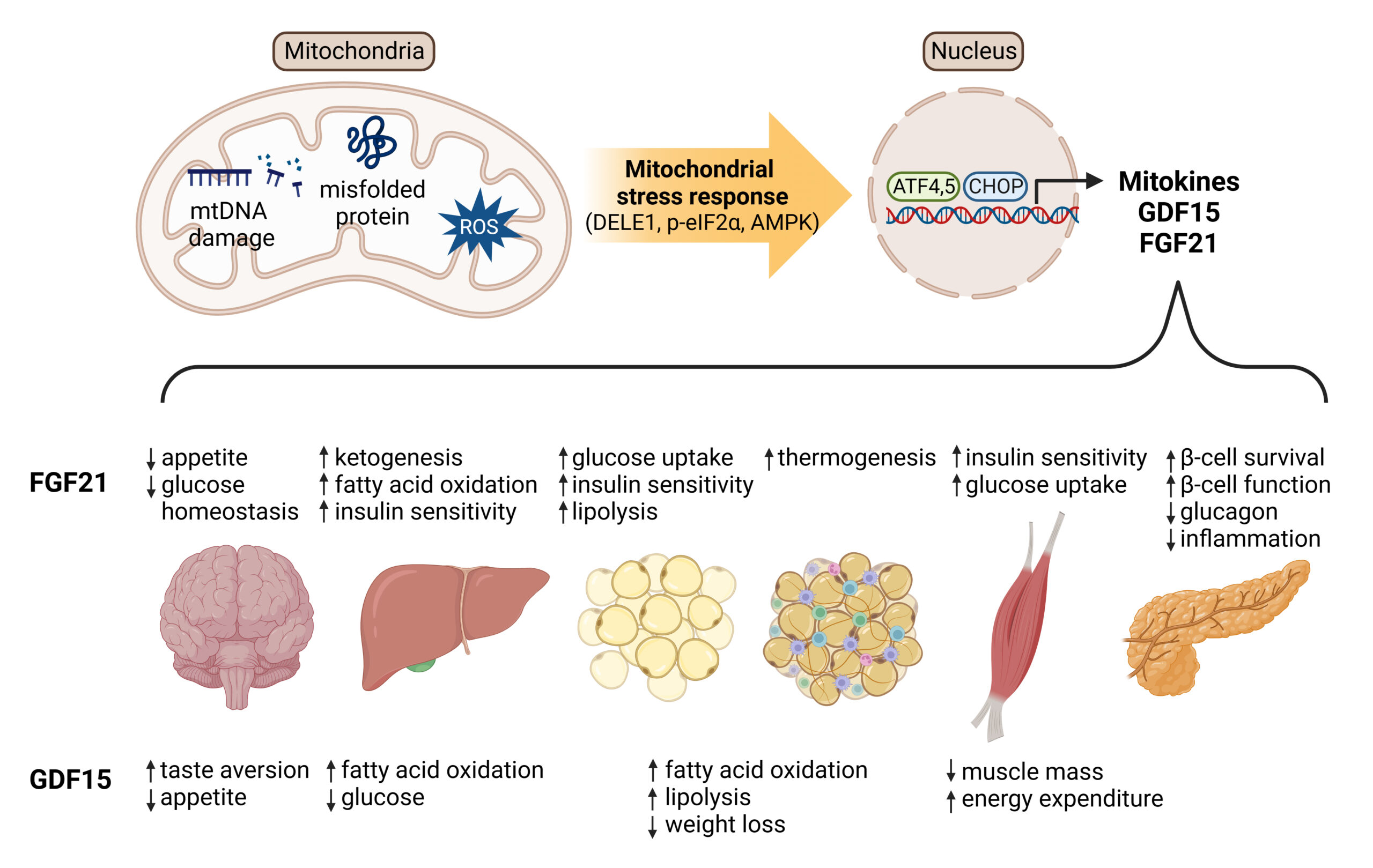

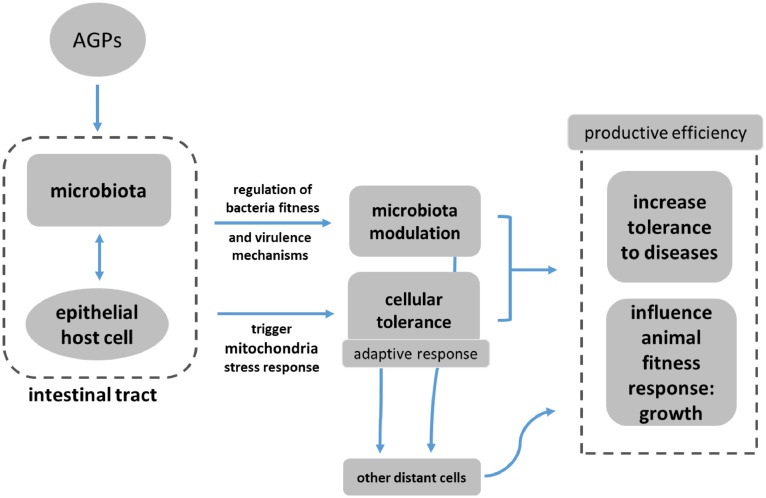

The antibiotic-free (ABF) production movement accelerated further in 2025. With the EU ban on AGPs in place since 2006 and the US moving toward voluntary phase-out, the entire industry is in active transition. The key challenge: AGP removal creates enteric health gaps that must be addressed with alternative tools. Without effective management, removal of AGPs leads to increased necrotic enteritis, Campylobacter colonization, and poorer FCR.

6.2 Heat Stress – A Growing Production Challenge

Climate-related heat stress was a highlighted research and production topic in 2025. Modern high-performance broiler genetics have been selectively bred for rapid growth under thermoneutral conditions. Heat stress impairs feed intake, FCR, immunity, meat quality, and reproduction. Management strategies:

- Dietary electrolyte balance adjustment (increase K, Na, reduce Cl where appropriate)

- Vitamin C and E supplementation at heat stress periods

- Betaine inclusion as an osmolyte; reduces supplemental methionine requirement under heat stress

- Feed schedule adjustment (limit feeding during hottest hours; early morning/evening feeding)

- Housing design investment: tunnel ventilation, evaporative cooling, adequate air velocity

6.3 In Ovo Technology

In ovo vaccination and nutrition delivery continued to advance in 2025. Key developments include high-throughput systems (3,000 eggs/hour at 99% accuracy) for in ovo vaccination and nutritional interventions. Early-life gut programming through in ovo delivery of probiotics, nutrients, and vaccine antigens is becoming an increasingly important hatchery-level biosecurity and performance tool.

CHAPTER 7: MARKET TRENDS & CONSUMER SHIFTS

7.1 Poultry Gaining Share vs. Other Proteins

Elevated beef prices throughout 2025 – driven by tight US cattle supply (herd at decades-long lows) and high demand – continued to push consumers toward poultry as a cost-effective protein. This dynamic is a structural tailwind for the broiler industry globally.

| Market Dynamic | Detail |

| US broiler net cash farm income 2025 | +27% YoY – livestock sector outperforms crop side |

| Global poultry market value (2025) | $316.77 billion; projected $433.98B by 2034 (CAGR 3.56%) |

| Global poultry export growth 2025 | +1.8% to 16.9 million MT |

| Supermarkets poultry market share | 42.1% of poultry distribution (2024) |

| Online poultry retail growth rate | CAGR 11.4% (fastest growing channel) |

| Italy – poultry share of total meat consumed | >44% in 2025 |

| FAO Meat Price Index – poultry | Decreased in 2025 from mid-2024 high (broiler ample supply) |

7.2 Cage-Free & Animal Welfare Commitments

The cage-free transition is structurally undersupplied in the US. Corporate commitments made in 2014–2017 implied a need for 220 million cage-free layers by 2025–26. Current production is well below that target. This creates both a market opportunity (premium pricing) and a risk (HPAI vulnerability concerns in cage-free systems). Producers must balance welfare compliance with biosecurity protocols.

7.3 Antibiotic-Free, Organic, and Specialty Products

Consumer and corporate buyer demand for ABF, No Antibiotics Ever (NAE), organic, and pasture-raised products continued to grow in premium markets in 2025. The pasture-raised egg segment reported 30% annual growth rates despite high price points. For integrated producers, this requires dedicated production lines with separate management protocols, supply chain segregation, and robust documentation systems.

7.4 Sustainability Pressure

Feed manufacturers and integrators are under growing pressure from retail and foodservice customers, NGOs, and regulators to demonstrate reduced environmental footprint. Key metrics under scrutiny:

- GHG emissions per kg of chicken meat produced (Scope 1, 2, and 3)

- Deforestation-free supply chains for soy (EU Deforestation Regulation – EUDR)

- Feed conversion ratio improvement as a sustainability lever

- Nitrogen and phosphorus excretion reduction (enzyme use, reduced CP diets, phytase)

- Water use per unit of animal protein produced

EUDR NOTE: The EU Deforestation Regulation requires companies to ensure that soy used in feed does not originate from recently deforested land. Implementation deadlines have been debated, but traceability requirements for soy origin – particularly from Brazil – are operationally significant for EU feed manufacturers and importers.

CHAPTER 8: STRATEGIC LESSONS & ACTION PRIORITIES

8.1 Summary: Top 10 Lessons of 2025

| # | Lesson | Key Data Point |

| 1 | HPAI is now a permanent structural risk, not a cyclical one. Biosecurity investment must be treated as core capital expenditure. | CDC: H5N1 now enzootic in North American wild birds; US flock 8% below 2022 baseline |

| 2 | Egg production is structurally more vulnerable than broiler production – different biosecurity and business continuity protocols are required. | 75% of HPAI losses = layers; broilers grew 1.4% in 2025 |

| 3 | Vaccination for HPAI is the central unresolved debate of the decade – expect DIVA strategies to become standard within 3–5 years as industry and regulators align. | 417 vaccine/research proposals submitted to USDA Grand Challenge |

| 4 | Trade concentration is a strategic vulnerability. Diversify export markets actively; do not allow 70%+ of any product to go to one trading bloc. | China + Mexico + Canada = 70% of US corn exports; 60% of soy; 45% of poultry |

| 5 | Grain prices are favorable NOW – lock in contracts and assess forward pricing opportunities while corn and SBM are at multi-year lows. | Corn -3.9% in 2025; SBM -4.3%; both 3rd consecutive annual decline |

| 6 | AMR regulations are accelerating everywhere. Transitioning to ABF production is no longer a ‘maybe’ but a ‘when’ – plan now. | EU: AMR in poultry ‘persistently high’ per EFSA/ECDC March 2025 report |

| 7 | EFSA’s 2025 WGS guidance fundamentally changes the cost and timeline of getting microbial feed additives authorized in the EU. | WGS now mandatory for all microbial characterizations; legacy dossiers need revision |

| 8 | Amino acids and precision nutrition remain the most cost-effective tool for diet optimization: lower CP, better FCR, lower N excretion, reduced enteric pathogen substrate. | Amino acids = 33.6% of global feed additive market by value |

| 9 | Brazil’s HPAI outbreak demonstrated both the vulnerability of global trade and the effectiveness of regionalized response protocols. | Brazil exports fell 12.9% in May but year-end positive; China temporarily banned; UAE stepped up |

| 10 | Climate/heat stress is an underappreciated production risk that compounds disease susceptibility and reduces performance in high-performing genetics. | IPCC: global surface temperature +0.9°C since mid-20th century; impacts on poultry FCR, immunity, mortality increasing |

8.2 Action Priority Matrix for Management Teams

| Priority Area | Immediate Actions (0–6 months) | Medium-Term (6–18 months) |

| HPAI Biosecurity | Complete USDA-style biosecurity assessments; audit wild bird access; upgrade water and air biosecurity; train all staff | Evaluate in-house monitoring technology; develop scenario plans for flock loss; build supplier contingency agreements |

| Feed Ingredient Procurement | Lock in corn and SBM forward contracts at current low prices; audit mycotoxin levels in incoming grain batches | Diversify supplier base; develop cost-switching matrices for corn/wheat/sorghum substitution as prices change |

| AMR / ABF Transition | Audit current antibiotic use protocols; identify critical intervention points where antibiotics can be replaced | Pilot ABF production line with full additive support program (organic acids, probiotics, phytogenics, prebiotics) |

| Regulatory Compliance (EU) | Review all microbial feed additive dossiers against EFSA 2025 WGS guidance; identify gaps requiring new data | Update all submission dossiers; ensure AMR surveillance data matches new 2025 EU requirements |

| Trade Policy Monitoring | Assign responsibility for tracking tariff changes weekly; map top 5 export customers and their import restrictions | Develop export market diversification plan; qualify 2+ alternative markets for each key product |

| Cage-Free / Welfare | Review corporate cage-free commitments vs. current supply; align with customer timelines | Design biosecurity protocols specific to cage-free environments; review insurance and contingency planning |

8.3 Key Indicators to Monitor in 2026

- HPAI detection frequency in fall-winter 2025–26 migration season – predictor of next egg price cycle

- USDA HPAI vaccine grand challenge awards – signals timeline for commercial vaccine availability

- EU feed safety simplification package progress – potential relief on additive authorization timelines

- EUDR deforestation enforcement timeline – soy traceability compliance clock

- Brazil HPAI market re-entry for China – recovery of the world’s #1 poultry export relationship

- US corn/soy 2026 planting intentions (March) – USDA Prospective Plantings report is the key 2026 procurement signal

2025 demonstrated that the feed and animal production industry operates in an environment of simultaneous, compounding risks – biological, geopolitical, regulatory, and climatic. The companies that performed best were those with robust biosecurity infrastructure, agile procurement teams, clear AMR transition roadmaps, and diversified market exposure. There is no single silver bullet. Systematic risk management, not reactive crisis response, is the competitive differentiator going forward.

KEY SOURCES & REFERENCES

This article draws on data and analysis from the following sources:

| Organization | Document / Resource Referenced |

| USDA APHIS / FAS | HPAI flocks data (2025); Livestock & Poultry World Markets (Dec 2025); WASDE reports; Five-Pronged HPAI Strategy |

| FAO | Food Outlook June 2025; OECD-FAO Agricultural Outlook 2025–2034; FAO Meat Price Index |

| OECD | OECD-FAO Agricultural Outlook 2025–2034 (July 2025) |

| WOAH | HPAI Report #68 (Feb 2025); State of World Animal Health 2025; HPAI 10-Year Strategy 2024–2033 |

| EFSA / ECDC | Joint AMR Report (March 2025); 2025 QPS updated list; EFSA 2025 Guidance on Microorganisms (Nov 2025) |

| PAHO / WHO | Epidemiological Update H5N1 in the Americas (Jan 2025) |

| US Congressional Research Service | HPAI Outbreak 2022–Present (April 2025); Egg Prices and HPAI (May 2025); 2025 Tariff Actions |

| American Farm Bureau Federation | Retaliatory Tariffs Report (March 2025); Turkey Market Intel (Oct 2025) |

| CoBank / NAMA | AgriFood Policy Update (Oct 2025); Farm Income Forecasts 2025 |

| WATTPoultry.com | HPAI 2025 Layer Roundup; Broiler Production Outlook; Demand Drives Poultry to New Highs (2025) |

| The Poultry Site | Weekly Global Protein Digest; HPAI Global Spread (2025) |

| AviNews | Global Poultry Meat Output 151.4M Tons 2025 (Dec 2025) |

| Innovate Animal Ag | HPAI Supply Constraints Cost Americans $14.5B (2025) |

| DTN / PF | Grain Futures 2025 Annual Review (Jan 2026) |

| USDA ERS | Corn & Other Feed Grains Outlook (2025–26 WASDE updates) |

| Frontiers in Veterinary Science | Phytogenic feed additives – gut health modulation (Aug 2025); Antibiotic alternatives – One Health (Jul 2025) |

.

.